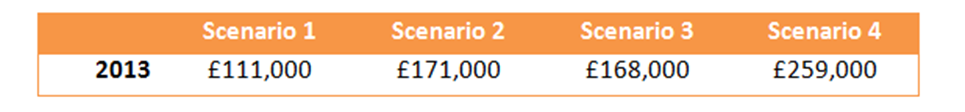

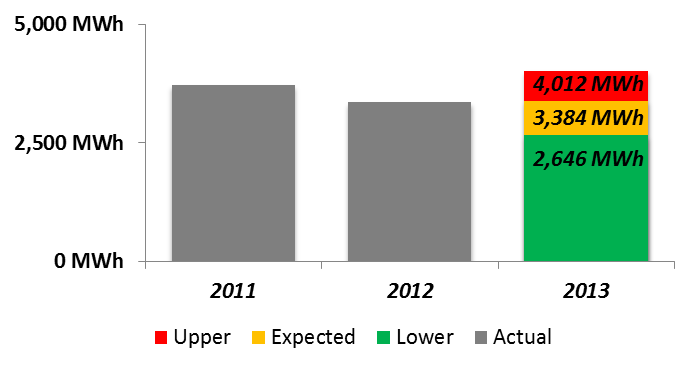

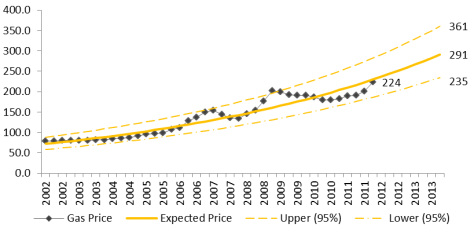

I’ve taken the extremes from my previous two blogs and combined them to give four scenarios: mild year at lowest unit price increase (5%); harsh year at lowest unit price increase; mild year at highest unit price increase (65%); harsh year at highest unit price increase. I have assumed the cost of gas to be 4 pence per kWh this year and then inflated it in line with the upper and lower bounds of the model presented in part 1 of this series.

These four scenarios are shown in the table below and the values have been rounded to the nearest £1000. At 4 p/kWh the average of the previous two year’s consumption is £141,000. If this was your budget for 2013 and it turned out to be a mild year and the gas prices had only increased by 5% then you could be under budget by £30,000. But if it is a harsh winter and gas prices are at 6.5 p/kWh then your budget could be blown.

Gas prices are more dominant and they probably will increase and as for the weather, who knows? The simple fact is that doing nothing could be costly. Even if your energy consumption remains broadly constant then your energy spend could increase and interestingly, if the weather causes an increase in heating demand then energy spend will increase and so too will your CRC liability (which at £12/ tn CO2e is equivalent to 0.22 p/kWh of gas consumed).

With an energy management system in place and being used appropriately the risks discussed in this series of blogs could present opportunities to reduce energy costs and if prices increase then so too will the magnitude of the savings – can you afford not to be using an energy management system?

RSS Feed

RSS Feed